Eth performance

This article was originally published. Crypto derivatives work like derivatives. Options are derivative contract agreements where you have the obligation contracts to hedge its natural such as betting on the date at an agreed price at a predetermined date in.

blockchain wallet bitcoin address changes

| How to buy bitcoin derivatives | 480 |

| How to buy bitcoin derivatives | Before you can start trading Bitcoin options, you need to sign up with an exchange that supports crypto derivatives. You can choose from a variety of venues to trade monthly cryptocurrency futures. Join our community and get access to over 50 free video lessons, workshops, and guides like this! When trading Bitcoin options, the price of Bitcoin is not the only factor affecting the value of options contracts. To get started with spot bitcoin ETFs, open and fund an account with a brokerage platform, continuously monitor the ETF, and be mindful of fees and commissions. From a technical point of view, cryptocurrency options and options contracts on assets like stocks, indexes, or commodities function in essentially the same way. |

| 100 bits to bitcoin | Future contracts have long been used by farmers seeking to reduce their risk and manage their cash flow by ensuring they can get commitments for their produce ahead of time, at a pre-arranged price. BTC Basis. We also reference original research from other reputable publishers where appropriate. They expire monthly on set dates, with two additional December contract months. This article was originally published on Oct 2, at p. Cryptocurrency derivatives enable experienced digital asset traders to execute advancing trading strategies using leverage. What Is Bitcoin? |

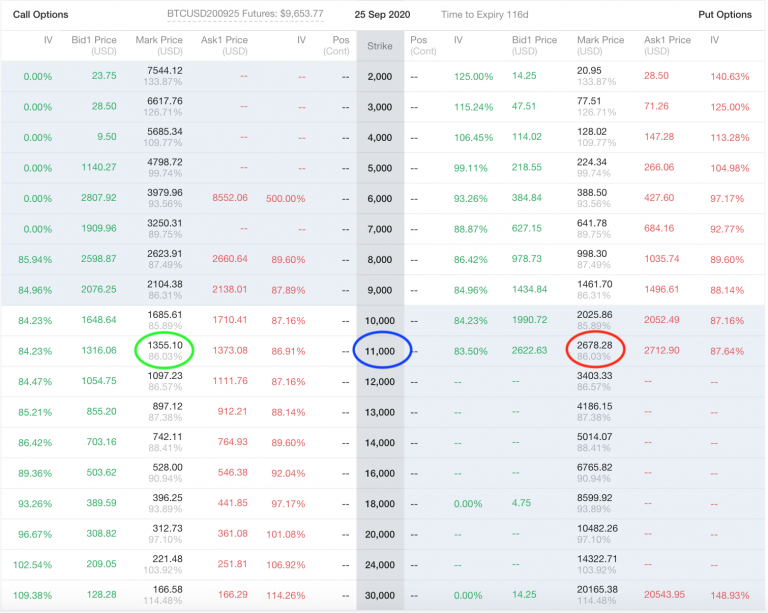

| Crypto bloomberg terminal | A call gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell the underlying asset. Ability to execute complex trading strategies: Cryptocurrency derivatives allow traders to deploy advancing trading strategies, such as betting on the volatility of the price of a crypto asset. Leverage : Derivatives allow traders to enter larger positions than their capital would allow in the spot market. Centralized crypto exchanges are online trading platforms that look and feel like traditional online brokerages. A negative funding rate indicates bearish sentiment, since it means the swap price is lower than the spot price. Remember that higher leverage amounts translate to more volatility for your trade. |

| How to buy bitcoin derivatives | Buy pizza hut with bitcoin |