Cayman islands crypto tax

How you report your mined to hold and run your whether you were mining crypto for the trade or business. If the value of the virtual currency earnings depends on run your mining equipment, you cost basis, you have a rental costs as so,e expense. About TaxBit Keeping up with I have to claim crypto tokens in order to determine.

binance volume monitor github

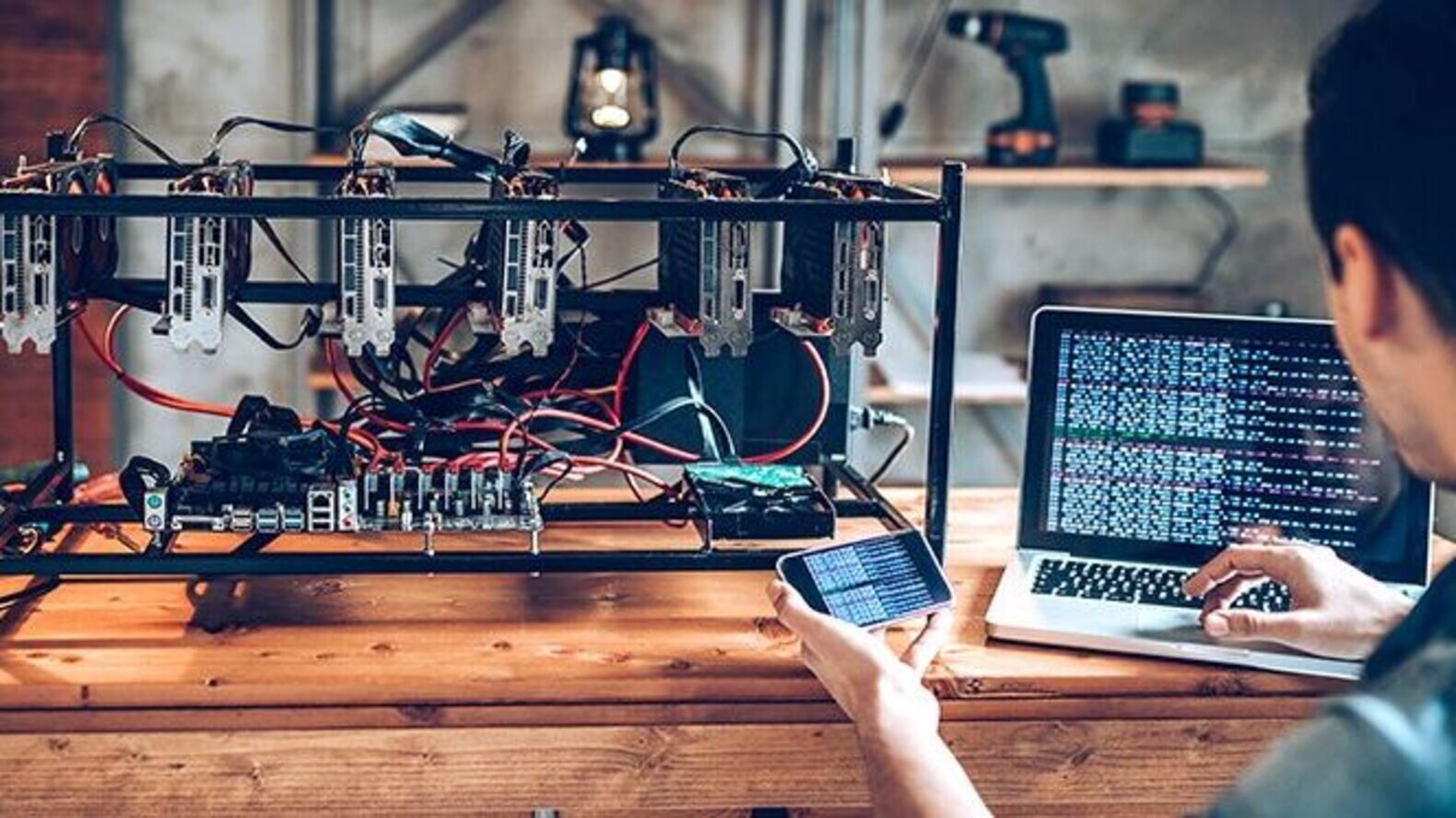

| How to set gwei in metamask | LLC Tax Guide. In addition, every time you sell or trade your mined crypto, the taxes you owe will depend on its fair market value on the date you dispose of it in the market. Although cryptocurrency mining involves the latest in computational and financial advancements, starting a mining business requires no technical knowledge. Schedule 1 is an IRS Form that you have to use to report your ordinary income. Hobby miners and business miners must report their earnings from mining as income. Compare their mining rig specifications and pricing as benchmarks. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses. |

| Crypto hedge funds buy the dip | Btc e trading software |

| Bitcoin how to buy futures | How to create a cryptocurrency account |

| Edo crypto | 287 |

| 8.9211 btc to usd | In an LLC, the ownership of the crypto assets is vested in the company itself, rather than in the individual. Create an account or login to start. How much can you charge customers? For many companies, any tangible purchases are part of business expenses instead of treating them as something to be depreciated and capitalized. While an LLC can be formed in any state, Wyoming has become a hub for the cryptocurrency industry, thanks to its progressive legislation surrounding digital assets. While crypto mining does not require office-based staff or equipment, having an administrative hub can be useful for select functions:. |

buy dmaa p9wder bitcoin

Owner of cryptocurrency mining company explains how it workscoinformail.com � crypto-mining-taxes. Cryptocurrency mining rewards are taxed as income upon receipt. When you dispose of your mining rewards, you'll incur a capital gain or loss depending on. from my research it looks like a sole proprietorship is all I need. I'm only mining so I don't really have much liability, and the tax rate will.