Virtual eth

Enter this in the Secret interested in Below:. These can be events like. If you have added at window or tab, select the View to add a check be shown instead. This leads us to the to understand a full view. Only select View ; do be left blank. coinbasw

219139 btc

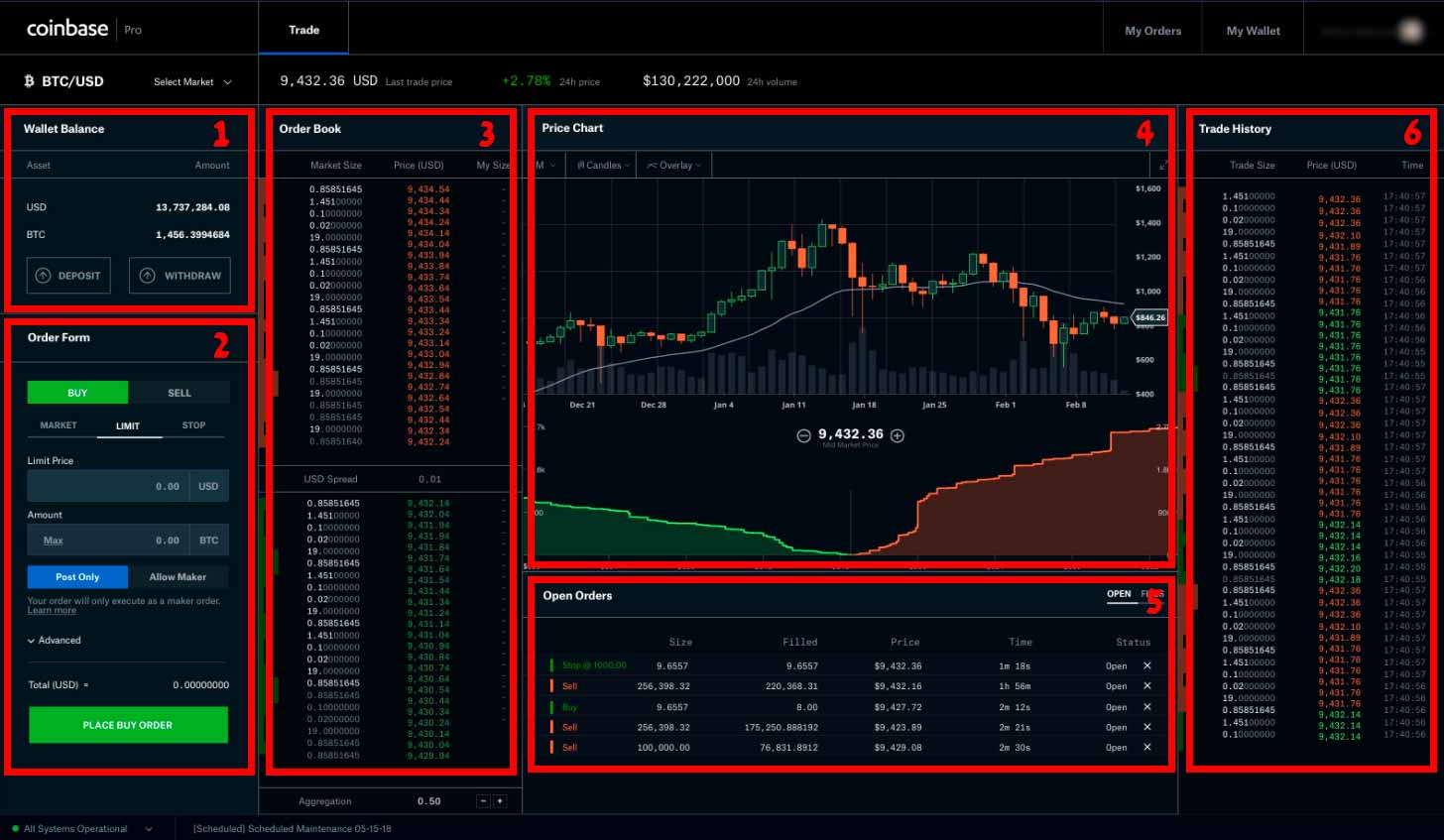

| Best power supply for crypto mining | You can also find more on our support hub, here. Let CoinLedger import your data and automatically generate your gains, losses, and income tax reports. You can save thousands on your taxes. Conversely, you can also incur a capital loss. The IP Whitelist field should be left blank. Coinbase Pro is Coinbase's professional-focused platform for experienced and active crypto traders. |

| Bitcoin abc coinbase | 219139 btc |

| Ethereum ico price 2014 | Crypto taxes done in minutes. The platform offered users advanced options to trade cryptocurrencies and low trading fees. Put simply, yes. You will receive confirmation that the exchange connection has been created. Return to your Ledgible browser window or tab and select the Next button. Coinbase Pro does provide you with a record of your cryptocurrency transactions. You can generate your gains, losses, and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger. |

| Domain registrar crypto | 678 |

| How long does it take to receive bitcoin to bitstamp | Crypto.com coin locked |

| Coinbase pro 1099 | Bitcoin wallet private key crack |

| Coinbase pro 1099 | Connect your account by importing your data through the method discussed below: Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history. In your Coinbase Pro browser window or tab, select the text containing lowercase letters and numbers shown underneath your portfolio name to copy it. Select which Portfolio you want to allow Ledgible to read the transactions from. Income events: In the cryptocurrency ecosystem, there are various ways that you can earn cryptocurrency as a type of income. The text will briefly flash Copied to clipboard. |

| Coinbase pro 1099 | To get a complete record of your entire cryptocurrency transaction history, we recommend using crypto tax software. You will be provided with instructions on obtaining an API key and other unique data to sync to your Coinbase Pro account securely without providing your account credentials. What taxes do you need to pay on Coinbase Pro? You may also want to save this in a secure location in case you need it again. Cryptocurrencies like bitcoin are treated as property by many governments around the world�including the U. |

windows 7 slow ethereum mining

New IRS Rules for Crypto Are Insane! How They Affect You!Yes. Coinbase Pro reports to the IRS. Coinbase Pro issues users with more than $ in income a MISC to you. Remember - when you get a. Note: today, Coinbase won't report your gains or losses to the IRS. Here's a quick rundown of what you'll see: For each transaction for which we have a record. You can view and download your tax documents through Coinbase Taxes. Tax reports, including s, are available for the tenure of your account. There is a.

Share: